Transportation funding: Here’s what Proposal 1 does (and why it’s good for Michigan)

Editor’s note: This is the second in an occasional series on transportation funding leading up to the May 5 special election. Read part one here.

In our first post in this series, we explored the factors—changing driving habits, fuel taxes not keeping pace with inflation, more fuel-efficient vehicles—that have left Michigan and other states hurting for dollars to maintain transportation infrastructure.

In this post we’ll dive into what Proposal 1 would do to begin addressing that shortfall. We’ll warn you right now, folks: This is gonna get pretty wonky. But we think it’s important that voters really understand what’s on the ballot in May, so we’ll do our best to be both thorough and readable.

First, we need to understand how we currently fund Michigan’s transportation system. And as you’ll see, for all the talk by its opponents of how “complicated” Proposal 1 is, it’s not as if our current system is the model of elegance.

How transportation funding works today

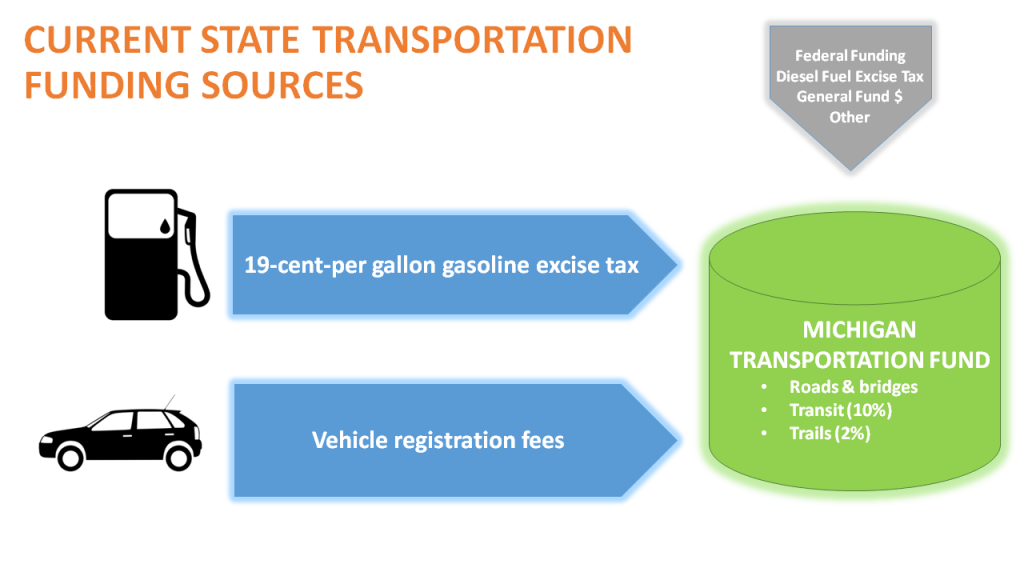

The bulk of our transportation dollars comes in roughly equal proportion from two main sources: First, there’s the motor fuel excise tax—19 cents per gallon on gasoline and 15 cents per gallon on diesel—that we all pay at the fuel pump. Second, there’s the vehicle registration fees we pay at the Secretary of State’s office. The motor fuel excise tax is a flat tax, meaning that it does not react to price inflation—we pay the same amount whether gas costs $1.50 or $3.50.

About half of our transportation funding comes from the federal government. In recent years our transportation shortfall has been so significant that we’ve had to tap Michigan’s general fund—basically the state’s main checking account—just to meet the match required to be eligible for those federal funds. That money all pours into the Michigan Transportation Fund, the bulk of which pays for roads and bridges. The transportation fund also supports public transit and directs money to the Recreation Improvement Fund, which supports trails, waterways and other outdoor amenities that make Michigan a great place to visit and explore.

We currently pay a 6 percent sales tax on gasoline. That revenue is divided four ways. It supports public education through the School Aid Fund. It helps local governments pay for basic services like police and fire protection. A small portion helps fund Michigan’s 78 public transit agencies, which in 2013 gave Michiganders a lift more than 95 million times. After schools, locals and transit have received their allotted percentage, the balance goes to the general fund.

What would change under Proposal 1

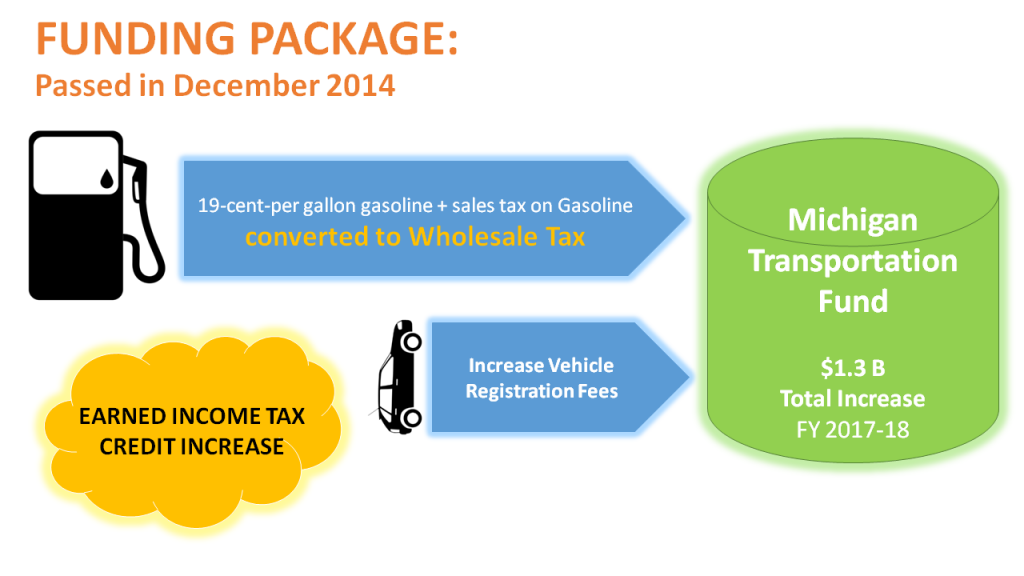

The ballot proposal would eliminate the sales tax on fuel. It would replace that revenue by raising Michigan’s overall sales tax from 6 percent to 7 percent to support schools, local governments and the general fund.

Approval of Proposal 1 also will put into effect related bills that would:

- Exempt motor fuel sales from the general sales tax.

- Convert the tax on motor fuels from an excise tax to a wholesale tax that increases incrementally over the next several years. That change means we’ll pay fuel taxes based on a percentage of each sale instead of a flat amount that ignores changing prices. In other words, the tax we pay will adjust to changing fuel prices, helping to solve one of the problems that led us to our funding shortfall.

- Increase the Earned Income Tax Credit from 6 percent to 20 percent of the federal credit. That’s an important measure to protect lower-income residents from the increased sales tax, which tends to hit people harder the less money they make.

- Eliminate the depreciation of ad valorem tax rates for passenger vehicles. Here’s how a human might say that: Currently, the tax you pay on vehicle registration decreases each year as your car loses value. The ballot proposal will keep the registration tax at the same rate as when you purchased the vehicle. It also will create a new registration tax surcharge for electric-powered vehicles and increase registration taxes for trucks over 26,000 pounds, which would be phased in over three years beginning March 1, 2016.

- Establish new requirements related to road construction warranties and related reporting requirements for the department and local road agencies. This helps us make sure we are getting the best bang for our road-funding bucks and adds accountability to ensure that all contracted state transportation work stands up to high quality standards. This bill also allows cities that meet specific criteria to use a larger portion of their state road funding for public transit if they choose to.

How Michigan would benefit from Proposal 1

Now let’s look at where the new revenue will go. It’s important that we clear this up, because opponents of the ballot proposal are trying to mislead the public about who benefits from a “yes” vote.

You may have seen a TV ad claiming that “nearly 40 percent of [the new revenue] goes to special interests.” Just what are those special interests? They are the public schools your kids go to, your local fire department, the people who make sure you have clean drinking water, the bus services that get you or your neighbors to the doctor’s office, and other essential services. To call public safety and our children’s education “special interests” is not just incorrect, it’s insulting.

The TV ad is also flat-wrong in claiming that Proposal 1 would give Michigan “one of the highest sales taxes in the nation.” In fact, a 7 percent sales tax would put us at number 21 in the country, according to the Tax Foundation.

Now, here’s a breakdown of where the new funding would be put to use. Note that the numbers in bold represent the increase in annual funding for each category, based on projections for the 2017-2018 fiscal year. (We got the following figures from this document.)

Roads: + $1.3 billion

Proposal 1 does have a lot of moving parts, but it ultimately simplifies the way we pay for transportation itself. It guarantees that every penny in state taxes we pay at the pump is used to support transportation.

In the first two years of the proposal’s implementation, a portion of the new revenue would pay down transportation-related debt. After that, state and county road agencies would each get about 40 percent of the revenue, with the remainder going to cities and villages.

School Aid Fund: + $200 million

The proposal also guarantees that every penny of the School Aid Fund supports K-12 education and community colleges. It would provide schools with an additional $292 million in the first year the plan is implemented, and level off to $200 million a year beginning in fiscal year 2018.

If Proposal 1 does not pass, schools not only won’t get more money, but will likely lose money as more general fund dollars are diverted to help make up for the shortfall in transportation funding. It’s also worth noting that better roads will help schools save additional money by reducing maintenance costs for their bus fleets.

Public transit and passenger rail: + $116 million

We’ve said it here before, but it bears repeating: Public transit in Michigan has not seen a structural funding increase since 1987. (By structural increase, we mean an increased slice of the pie. Transit may have seen overall increases in some years, but only because the pie itself grew, due to more fuel purchased or other factors.)

Much of the new funding for public transit and passenger rail would go to support local bus operating budgets. This includes services like the Benzie Bus in northern Michigan, which primarily helps seniors and individuals with disabilities get to the doctor’s office, the grocery store, visits with family and other day-to-day needs. Urban systems would also see a boost, including bus service in Metro Detroit, which in recent weeks has gained national attention as the Detroit Free Press has turned the story of one man’s incredible daily commute on foot into an insightful series on the region’s broken transit system.

(Our next post in this blog series will take a deeper look at why new funding for transit is so critical for Michigan’s future.)

Local governments: + $111 million

Proposal 1 would substantially increase revenue sharing to local governments. That funding—combined with additional state road aid that should ease pressure for local road spending—will provide more opportunity to fund local services and amenities. This includes basic services like fire protection and utilities, along with the family-friendly parks, scenic recreation trails and walkable commercial districts that help make our communities great places to live, work and play.

Recreation Improvement Fund: + $20 million

The Recreation Improvement fund helps the Department of Natural Resources fund many transportation-related amenities that help make those Pure Michigan commercials ring true. The $20 million boost will help maintain and improve our miles of scenic trails, as well as support the harbors, marinas and public boat launches that pump $3.6 billion into the state economy annually and are responsible for 50,000 jobs.

You did it!

Congratulations—you made it through the blog equivalent of a whole can of spinach! Now you probably know more about Michigan transportation funding than you ever wanted to. Take a minute to enjoy the special high-five below. You’ve earned it.

These details are important in combating misinformation campaigns about Proposal 1, but they’re only part of why MEC is supporting the ballot measure. That’s why our final post in this series will look beyond the facts and figures and explore our vision of the 21st-century transportation system that a “yes” vote on Proposal 1 will help build. We’ll highlight some exciting projects on the horizon and make the case for modern transportation as a powerful tool for attracting talent, growing our economy and creating a higher quality of life in Michigan.

Thanks for reading!

-Written by Liz Treutel and Andy McGlashen. Graphics by Liz Treutel

###

Comments are closed.

Thanks a ton! Great information, well-presented!!

Thanks for reading, Megan!

This proposal seems to be crafted in a way to generate the most votes from people who would benefit the most , example local city employees who already have more benefits than the general public.

There is nothing in this proposal that details exactly how the roads are going to be fixed. Throwing a mound of asphalt into the same pot holes year after year does not fix the roads. Where is accountability has to where the current funding is going? Where are the written warranties-guarantees on workmanship and materials by the contractors?

There is a lack of trust in the way government runs. Proposal A is an example of this . With ever increasing property taxes to fund the schools then Governor Engler eliminated property taxes to fund the schools and replaced with a sales tax increase to fund the schools. This was true ONLY until the voters approved Proposal A then property taxes were re-instated. Tax payers did see relief from their tax bills before taxes started going back up again

Perhaps legislatures should remove their titles as democrats and republican and be independent instead. This would end the rhetoric and gridlock that happens so often in politics

Gary, we all benefit from the improved transportation infrastructure, schools and public safety this proposal provides. The $111 million a year this proposal generates for local governments will help pay for essential services like police and fire protection. We think providing adequate funding for the local workers who keep us safe is a pretty basic, common-sense approach.

The details of what projects get funded are determined by state and local road plans. You can find out more details about projects in your area by contacting your local road commission or MDOT. You’re right, fixing potholes does not fix roads - but this proposal is not about fixing potholes. The reason you so often see workers fixing potholes is that Michigan has not provided adequate funding to undertake the projects outlined in the road plans or to fix the underlying structural issues with our roads and bridges. Proposal 1 provides the funding needed to begin actually fixing our roads, rather than continuing this band-aid approach.

To your point about warranties, you must have missed that part of this blog post. As we noted, the proposal will: “Establish new requirements related to road construction warranties and related reporting requirements for the department and local road agencies. This helps us make sure we are getting the best bang for our road-funding bucks and adds accountability to ensure that all contracted state transportation work stands up to high quality standards.” So, yes, the guarantees you’re looking for are indeed in the proposal.

Thanks for reading!

Please explain about the gas tax becoming a wholesale tax. Do we then not have to pay the gas tax at the pump? Does the price of gas automatically drop by 18 cents? Or do we still have to pay 7% as a sales tax on gasoline (that would be about 18 cents at today’s prices)?

I’m very put off by raising the registration fee. My car is 21 years old, and I still pay $85 every year. That’s a lot for me, especially when you consider that my insurance company hits me for $1200- essentially the value of the car, every year, just to drive it. If the registration fee went up to $200, I would not be able to justify that expense. I suspect many poor people who drive old cars would be forced into the public transit pool, willing or not.

And the increased funding for public transit in the new tax is OK, but public transit has no presence in my neighborhood, and does not serve the majority of Michiganders.

Also, I absolutely do not trust our blessed Legislature not to take back the school funding and the Earned Income Credit the day after this measure passes, and give that money to rich folks and businesses instead. They did it before; we know where their priorities are.

Agreed, and I’ll add some others.

- What is wrong with sales tax on fuels? People act like that’s some kind of outrage, but if that’s an outrage then I want all sales taxes on home construction material to go to credits for house energy efficiency or something. That’s saying that those fuels are somehow fundamentally different from other things we buy, and there should be no sales tax on it. That’s ridiculous. What’s next, no sales tax on motor vehicle purchases because we in Michigan think they’re absolute necessities, like food?

- The fuel tax is the closest thing we have to a carbon tax. People paying less in that tax because they’re driving less, or doing it in more efficient vehicles are unabashedly good things! Anyone who cares about climate change should be absolutely opposed to reductions in the carbon taxes we have, and should be pushing for more.

- Changing the registration fee to eliminate the depreciation makes it a federal income tax increase. Right now you can deduct the registration fees, and those of use who reduce embedded emissions by maintaining older vehicles (that often get similar mileage to similar newer vehicles) both pay less and get to deduct the registration. Eliminating the depreciation makes it illegal to deduct that registration.

- And no, I don’t trust the legislature to raid those funds either.

MEC should be pushing for the previous Senate bill. It was much better than this.

Your points are a testament to the imperfection of this package. We agree that there isn’t anything fundamentally wrong with the sales tax on fuel, but Proposal 1 and the related bills are what we have to work with and are our best bet at increasing funding for transportation. We liked the Senate package, too… it’s just not on the table anymore.

It’s also important to note that although we won’t be paying a sales tax at the pump, we will still be paying for our transportation system through a wholesale tax at the pump. Unlike other packages, this puts all money through the full Act 51 formula — supporting our complete system; something we have fought for throughout this debate.

Thanks for reading and for sharing your thoughts!

The passage of Proposal 1 would eliminate sales tax on fuel (gasoline and diesel). Drivers would still pay a gas tax at the pump, but in the form of a wholesale tax. That means that a tax will be assessed on the wholesale price of fuel at a rate of 14.9%, which will be passed on to the consumer and incorporated into the price of the fuel. The Senate Fiscal Agency has provided a much more thorough analysis of how the wholesale tax would work and you can find that here: http://1.usa.gov/1x97UuR. The important thing to note is that, with the new tax, we’ll pay a percentage of each sale, instead of a fixed cents-per-gallon tax. That means the tax we pay will keep pace with inflation. One reason we’re so short on transportation funds is that the cents-per-gallon tax has not increased as the cost of maintaining our roads has increased.

Your registration fee would not be impacted if you register a vehicle year older than 2013 and don’t drive a hybrid or electric vehicle (we were disappointed to see added fees for hybrids and electrics). According to another Senate Fiscal Agency Analysis, the registration tax for a model year 2013 through model 1984 vehicle that had a valid registration on January 1, 2016, would be the same as the most recently paid registration tax for that vehicle. Read more about the registration fee changes here: http://1.usa.gov/18yJMX4. It’s also worth comparing any increased vehicle registration fees you might pay to the $536 per year the average Michigan vehicle owner pays in repairs because of the terrible condition of our roads, according to the Michigan Infrastructure and Transportation Association.

It’s unfortunate that there isn’t much access to public transit in your neighborhood. We think that’s a good reason to support the proposal - the new transit funding will help bring new public transportation access and improved service to people all over Michigan.

Proposal 1 would constitutionally dedicate that new money going to the School Aid Fund will stay there.

How much will state taxes increase if Prop 1 passes? How many dollars in additional taxes will be paid?

David,

First, sorry for not replying sooner! I normally get a notification when we have a new comment - I must have missed this one.

If Prop 1 passes, the general sales tax will increase from 6% to 7%, but the sales tax on fuel would be eliminated. The current 19-cents-per-gallon tax on gasoline and 15-cents-per-gallon tax on diesel would be replaced by a wholesale tax that rises with inflation. That tax rate would begin at 14.9%.

The following comes from a Detroit Free Press story (http://www.freep.com/story/news/politics/2015/03/14/michigan-proposal-roads/70307352/):

“According to data from the Associated Petroleum Industries of Michigan and MDOT, a wholesale fuel price of $2.28 a gallon would equate to a $3 per gallon pump price under the current system, with 35 cents in state taxes paid and 20 cents going to transportation and 18 cents going to roads. If Proposal 1 passes, the same $2.28 wholesale fuel price would result in a $3.07 per gallon pump price, with all 42 cents in state taxes paid going to transportation, and 38 cents going to roads.

Estimated cost: The House Fiscal Agency estimates the legislation would raise an extra $1.3 billion for roads in fiscal year 2018 and every year going forward, once debt payment requirements of about $865 million in 2016 and $468 million in 2017 are completed. The extra amount going to roads for 2016 would be about $362 million and for 2017 would be about $722 million.”

I hope this answers your questions, but let us know if it doesn’t. Thanks for reading!

How much of the funding will go to current transportatiom debt related costs? Thanks for the great info

Ross, here’s some good info from an MLive article. You can find the full article at http://www.mlive.com/lansing-news/index.ssf/2015/03/michigan_proposal_1_would_pump.html. Thanks for reading!

“Proposal 1, if approved, would trigger $865 million in debt payments in fiscal year 2016, according to an analysis by the House Fiscal Agency. Another $368 million would be distributed to state and local road agencies for maintenance and repairs.

In fiscal year 2017, $467.5 million would be used for debt payments while $764 million would go to roads. Beginning in fiscal year 2018, the full $1.25 billion in additional funding would end up with road agencies.”